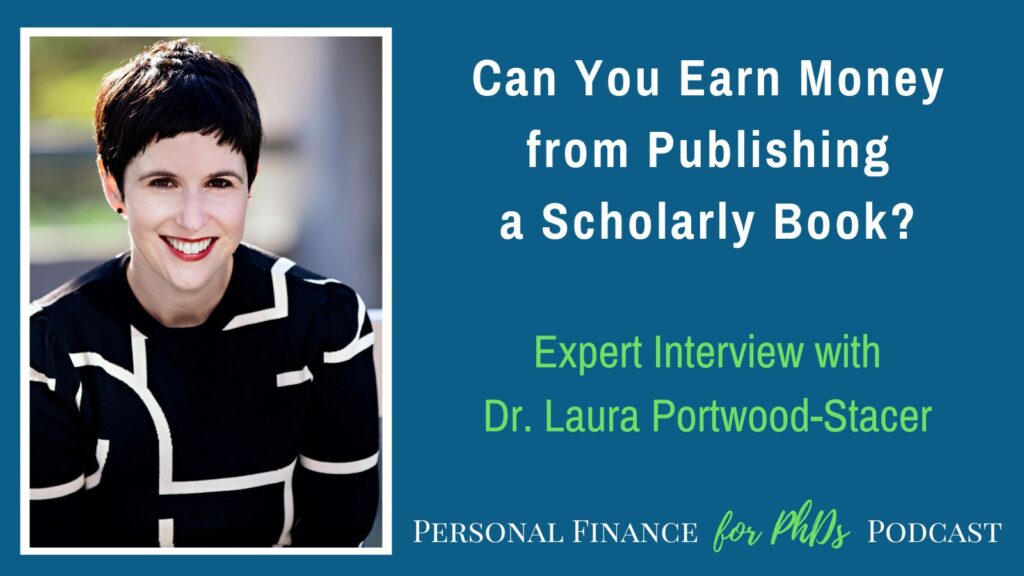

In this episode, Emily interviews Dr. Laura Portwood-Stacer, a developmental editor with Manuscript Works specializing in authors publishing with scholarly presses. Laura has personally published two books with university presses and has a third under contract and has worked with hundreds of other authors. Laura describes why a prospective author would choose a scholarly press over a household-name publisher or self-publishing. Laura and Emily systematically discuss how publishers earn money, how authors earn money (directly and indirectly) from their books, and the costs of publication. While publishing with a scholarly press is primarily a labor of love, Laura gives ranges and examples of how much an author might earn from royalties and an advance, if any, depending on the type of book they publish.

Links mentioned in the Episode

- PF for PhDs Tax Workshops (Individual Purchase)

- PF for PhDs Tax Workshops (Sponsored)

- The Book Proposal Book, Dr. Laura Portwood-Stacer’s Book

- Manuscript Works, Dr. Laura Portwood-Stacer’s Website

- The Manuscript Works Newsletter, Dr. Laura Portwood-Stacer’s Newsletter

- PF for PhDs Subscribe to Mailing List

- PF for PhDs Podcast Hub

Teaser

Laura (00:00): But if you have research that is applicable in industry or policy, or places that have kind of other kinds of funding, you can command more money than you ever would make from the book itself, in speaker’s fees, or consulting fees or things like that. So, you can sort of think of the book as a strategic investment in your reputation and your platform that then would allow you to expand higher goals In other venues.

Introduction

Emily (00:34): Welcome to the Personal Finance for PhDs Podcast: A Higher Education in Personal Finance. This podcast is for PhDs and PhDs-to-be who want to explore the hidden curriculum of finances to learn the best practices for money management, career advancement, and advocacy for yourself and others. I’m your host, Dr. Emily Roberts, a financial educator specializing in early-career PhDs and founder of Personal Finance for PhDs.

Emily (01:02): This is Season 17, Episode 5, and today my guest is Dr. Laura Portwood-Stacer, a developmental editor with Manuscript Works specializing in authors publishing with scholarly presses. Laura has personally published two books with university presses and has a third under contract and has worked with hundreds of other authors. Laura describes why a prospective author would choose a scholarly press over a household-name publisher or self-publishing. Laura and I systematically discuss how publishers earn money, how authors earn money (directly and indirectly) from their books, and the costs of publication. While publishing with a scholarly press is primarily a labor of love, Laura gives ranges and examples of how much an author might earn from royalties and an advance, if any, depending on the type of book they publish.

Emily (01:53): The tax year 2023 version of my tax return preparation workshop, How to Complete Your PhD Trainee Tax Return (and Understand It, Too!), is now available! This pre-recorded educational workshop explains how to identify, calculate, and report your higher education-related income and expenses on your federal tax return. Whether you are a graduate student, postdoc, or postbac, domestic or international, there is a version of this workshop designed just for you. I do license these workshops to universities, but in the case that yours declines your request for sponsorship, you can purchase the appropriate version as an individual. Go to PFforPhDs.com/taxreturnworkshop/ to read more details and purchase the workshop. You can find the show notes for this episode at PFforPhDs.com/s17e5/. Without further ado, here’s my interview with Dr. Laura Portwood-Stacer.

Will You Please Introduce Yourself Further?

Emily (02:58): I am delighted to have joining me on the podcast today, Dr. Laura Portwood-Stacer, who’s the owner of Manuscript Works. Laura and I kind of met on Twitter. She was recommended to me by another past podcast guest Dr. Katie Peplin. And Laura is a developmental editor of sorts. And so we’re gonna get into more of that line of work. And actually in preparation for this interview, I read her excellent book, the book proposal book, which is all about people publishing books with scholarly presses. So that is the subject for our interview today. Laura, would you please introduce yourself a little bit further for the audience?

Laura (03:30): Yeah, I’m so happy to be here. Um, so yes, my name is Laura Portwood-Stacer. For the past nine years, I have run a company called Manuscript Works, where I help authors, um, navigate the book publishing process, specifically scholarly authors. Um, building on my background as an academic, um, I got a PhD. I published my dissertation as a book. Um, and now I’ve moved on to helping others navigate that process, which can be very anxiety provoking and you know, there’s not a lot of guidance out there, so I’m trying to fill in that gap.

Scholarly Publishing, Trade Publishing, and Self-Publishing

Emily (04:02): Yeah, and so any listeners who want to go down this route, certainly again, I’m recommending the book proposal book. I found it very, very enlightening. Um, but we’re actually gonna be talking more today about the financial side of this because of course this is a personal finance, um, podcast. And because, um, that was left a little bit vague, I think, in your book, so I’m gonna see if you’re willing to share some, uh, more specific numbers or number ranges with us, um, as we’re going through the interview today. Um, so first of all, I just wanna help the listener understand the distinction between what we’re calling a scholarly press and then the publishing industry that they may be more familiar with, and then the self-publishing industry. So can you just tell us a little bit about how someone who thinks they would like to publish a book at some point, how they might know which is the right route for them to go?

Laura (04:47): Yeah, so I’ll say, uh, scholarly publishing is, um, sort of a narrow subset of the larger sort of traditional publishing industry, and it’s really focused on a certain segment of reader and a certain, um, distribution channel. So your readers, if you’re publishing with a scholarly press, your readers are going to be other scholars, um, people who are doing research, who are citing previous research in their own research, who are building on your research to write their own books or their own articles or, um, grants or whatever it is they’re doing. Um, and, and the distribution would be mostly directly to other scholars who might, you know, purchase from a publisher or purchase from an online retailer. Um, and institutional libraries, public libraries, um, uh, places that are sort of invested in furthering scholarly knowledge, right? So the focus is on scholarship, not necessarily on entertainment or, um, you know, personal improvement or the kind of things that you might pick up a book from Barnes and Noble for. Um, it’s really has sort of a professional scholarly bent to it. Um, whereas probably most of the publishers you’ve heard of that are household names that are not university presses. Um, they’re gonna be more focused on commercial books that people are, you know, just gonna wanna spend money on buy as gifts. They’re not necessarily serving that, um, intellectual purpose in the same way. There are some books that cross over from like scholarship to, um, a more broad audience. Um, and we can talk about where those kinds of books get published. Um, uh, but, but yeah, so that’s sort of the distinction between a trade publisher and a scholarly publisher. And a trade publisher, of course, is gonna be mostly selling in bookstore online retailers. They’re focus is not gonna be libraries or universities. Um, and then self-publishing is sort of a totally separate avenue. Um, and you know, I guess the difference there is that the, the distribution is kind of all up to you as as the publish as the writer. So you would need to find your readers. Um, you’re not sort of tapping into that built-in infrastructure of a scholarly publisher or a trade publisher.

Emily (07:19): I see. That makes total sense. And what really, I mean, maybe this is obvious to other people, but what impressed me with reading your book was like, oh, I’m really seeing how much work the publisher is putting into each one of these books that goes out. And of course, the audience that they have in mind, like you were saying earlier, and that is in the self-publishing realm, completely up to the author whether or not you’re going to invest in other people to help improve the work and and so forth. But that’s all part of the, the process when you go with, um, either a scholarly press or a trade press, right?

Laura (07:51): Yes. Yeah, and I’ll say that’s, you know, often there’s a perception among scholars that, you know, presses just profit off of our work and, and we provide this for free and we don’t make any money off of our books, so what are we getting out of it? But one of the big things you get out of it is that infrastructure that is already in place at the publisher where they know how to peer review the books, improve the content, um, produce the book so they look nice, then distribute it to the places that are most likely to buy it. All of that stuff is like, happens on the publisher’s end. Yeah.

Emily (08:23): Absolutely. Thank you so much for clarifying that. Okay. Now I wanna hear a little bit more about your books that you’ve published. Sure. What the process is kinda like, and then also what you do now for clients.

Laura’s Book Publishing Journeys

Laura (08:33): Yeah, so I have published two books to date. Um, I have a third under contract. Um, so my first book was a revision of my doctoral dissertation. Um, pretty typical straight straightforward process there. Um, I pitched it to a small independent publisher that got, um, absorbed by a larger commercial academic publisher. Um, so it was ultimately published with that larger publisher. Um, you know, it went through peer review. I did not receive an advance for that book. It has made minimal royalties, you know, a little bit over time, but not much. Um, but I wrote it for, you know, career reasons to just sort of get my research out there to make me more attractive on the job market. You know, kind of the typical reasons that a scholar would try to publish their dissertation. Um, my second book, which uh, was published, let’s see about eight years later, was the book proposal book, um, which is, um, it’s, you know, it’s a practical how to kind of book, uh, it’s, it is sort of research based in that it draws on my own sort of personal experience helping authors get their books published and write book proposals that impress the publishers they want to impress. Um, and you know, I did some research into the publishing industry to sort of inform that, the advice that’s in that book. Um, but, you know, it’s a different kind of, readership has a different kind of purpose. That book has been much more lucrative than the dissertation based book. Um, and we can talk about some of the reasons why, uh, if, if you want to get more into that. Um, and then my third book is currently under contract, so that means that I’ve written a proposal, I’ve pitched it to my publisher. Um, they have accepted it based on the strength of the proposal and on my previous, um, book with them. Um, and I have received part of an advance for it. I will receive the advance in installments, um, but I have not received any royalties for it yet because the manuscript has not been completed, uh, completely revised and approved and accepted for publication. So the book is not in production yet. We’re still a ways out from that.

Emily (10:48): Yeah, that’s fascinating. Um, I definitely wanna talk to you more about the financial aspects of this in a moment, but now I just wanna hear tiny bit more about how you serve your clients because I think it helps the listener to understand that you’ve not only had this personal experience, but you now have like the professional experience of helping, um, shepherd other people through this process.

Supporting Authors From Proposal to Publication

Laura (11:05): Yes. Yeah, so I mean, of course the personal experience is really helpful because I know the emotions that an author goes through. I have all those same anxieties, um, you know, about pitching my work to publishers and making a good impression and all of that. But I would say, um, the, the help I’m able to offer really comes from having been through this process with other people, um, in a wide variety of disciplines. Um, so I, uh, I basically help authors kind of distill what their book is supposed to be into a book proposal, help them write it in a way that is going to connect with publishers, that’s gonna speak to what publishers are looking for, which is not necessarily the same thing that academics are thinking about, um, when they’re thinking about their research. Um, and then, uh, you know, then I’ve, I’ve seen the process follow through where they actually get the contract and the, the offer and then get their book published. So, you know, I do online programs, so I’ve worked with hundreds of authors, um, who have been through this process. So getting to see sort of the different nuances and how it works at different publishers and, and all of that has been really helpful for getting that broad view of how it works.

The Financial Side of Publishing a Book

Emily (12:16): Awesome. So I wanna dive into a little bit more of the, the money aspects now, because that, of course your, your book is taking people step by step through the whole process. Um, but I want to just get some more details about like what people can expect if they <laugh> for financially if they decide to publish a book through this kind of press. I wanna start on how these books make money and how authors make money from them. So am I correct in assuming that money is made from these books by selling these books? Is that the direct way money is made by the publisher?

Laura (12:48): Yes.

Emily (12:48): Okay.

Laura (12:49): Yes.

Emily (12:50): Now, what do the authors get <laugh> after the publisher sells you books? You’ve mentioned advances, you’ve mentioned royalties. Can you define these a little bit further and talk about sort of the scope of what these contracts look like? ’cause some people get advances, some people don’t, maybe the royalties are different amounts for different authors. Like what’s the range here?

Laura (13:06): So yeah, so publishers, you know, even university presses, which are nonprofits, um, so, so they’re not necessarily trying to make a profit, um, but they are trying to stay open and they do rely on book sales to stay open. You know, I think there’s a misconception that they are just funded by their universities and some receive some funding from their universities, but that amount is of course shrinking, uh, with austerity and everything, um, you know, in university administration. So they really do rely on selling their books in order to stay open and keep performing their service to the scholarly community. Um, so, so that’s one reason why they are looking for books with a readership of hopefully hundreds of people, maybe thousands of people will wanna read each book that they put out. Um, so, and, and they are investing tens of thousands of dollars in producing each book. Um, and a lot of that goes toward the labor or the editorial labor, the production labor, um, but also materials, um, you know, everything that goes into making the book as a product. So, um, they are recouping that investment, um, in the form of the, the sales of the book. And in most cases they will share some of that, you know, recoup with the author in the form of royalties. Um, so the author would typically get of small percentage of whatever profit the book makes. So, so yeah, so they’re always sort of calculating, um, projecting profits and losses for each book. And based on that, they may think about, okay, what can we afford to share with the author and still break even on this book, or still even make a little bit of money that we could invest back into our press to help publish maybe some of the books that aren’t gonna sell as well. Um, and that’s where they’re figuring out, you know, how much money they’re gonna share with the author. And, and in advance is, um, the amount of money the, the publisher would give an author upfront before the book even starts selling copies. Um, and that is basically just an incentive to get the author to publish with that press. Um, so that is most likely to come into play when the press believes they have to compete for the book with other publishers. Um, and they’re also going to have to project pretty significant profits from the book, you know, so they’re not sinking even more into it without some prospect of getting it back out. Um, so, so advances, you know, scholarly publishers do sometimes offer advances again under those conditions where they think the book’s going to be profitable and they think they have to compete to land this author. Um, and the range of those advances varies a lot. It could be just in the low hundreds, more of like a token kind of thing. It could be a thousand dollars a and I’m speaking from experience of having worked with people who got advances for their dissertation books. Um, so it does happen. Um, but I would say the range has been from like a thousand, maybe 2,500, maybe $5,000. Um, that would be an advance that might be available. Not common, I would say, but available, um, depending on the project. Um, for, you know, people who are more established in their careers, they have a big name they could choose to publish with a trade press, but they have chosen a university press instead. Um, people who are writing a textbook or something that is likely to be widely adopted, not just read by a few hundred people but read by tens of thousands of college students, um, or, you know, scholars who are gonna use this book for some practical purpose. Um, that’s where you can get a higher advance maybe more in the five figures. Um, it’s not unheard of for a six figure advance to come from a university press, but that would be pretty rare. That would be them competing with a trade press that might be more used to dealing in those kinds of numbers. And they’re gonna expect that book to really pay off for them to help them keep the lights on for all the other books that they sell.

Emily (17:45): So, fascinating. Thank you for telling us those like orders of magnitude for the, the different types of books. That’s really, really helpful. Um, so let’s say, um, whether or not an advance was given, um, I think you said something like when the book sales exceed the costs that have been invested, then royalties are shared with the author. Is, is that correct that royalties don’t come from book number one, but only once costs have been recouped?

Laura (18:11): No.

Emily (18:11): Okay.

Laura (18:12): Um, not exactly. Um, so yeah, it’ll be written into the author’s contract, uh, and, and I’ve seen various types of offers. Uh, some university presses will say, okay, no royalties on the first 500 copies, say, um, ’cause they know they’re not gonna break even until they’ve sold 500 copies. Um, I would say that’s a less common than a royalty from copy one. Um, but you know, the press, it might not break even until later on, but they’ve factored in the fact that they are going to compensate the author something for sales of the book. Um, so, so yeah, it’s really hard to know what that break even point is, but, but publishers are like, you know, they have a lot of data points and they are really projecting out into the future optimistically hoping they’re gonna get to that break even point. Um, but the author will likely seal some money before that point. Probably won’t be a lot of money, but some money.

Emily (19:15): Okay. Let’s, I wanna get some orders of magnitude again. Sure. So let’s say for the example you gave earlier of like someone who’s trying to publish work arising from the dissertation that they wrote, um, that kind of book. How much money would they think they might make in the first year, let’s say? Are we talking two figures, three figures, four figures, five? Like where, what is the order of magnitude there in royalties?

Laura (19:41): Uh, uh, so it’s, um, it’s really hard to generalize, I’ll say. Um, but, so, uh, maybe some other numbers will kind of help this. So let’s say your book, um, retails for, I’m gonna say $20 just for simplicity’s sake, but most academic monographs are gonna be priced a bit higher than that. Um, but let’s say it’s $20, the way that the publisher calculates the royalty, you are likely going to see a dollar or less from each sale of that book. Um, let’s say there’s a, um, sometimes publishers have, um, a library version, a library edition that is, is actually priced at a hundred dollars. Um, ’cause they know only libraries are gonna buy it. They’re not trying to sell that to like your average academic reader, but they are gonna sell it to a library that’s gonna, you know, let dozens of people read it. Um, so they’re gonna sell that for a hundred dollars and the author might see $5. Again, it depends on the, the royalty structure that’s set up in the contract, but so you might see $5 from the sale of that book. So, you know, most academic monographs that begin as dissertations, they’re, you know, they’re gonna sell to a few hundred people realistically. Um, so, you know, let’s say a hundred libraries buy your book, that would be great. That’s a lot of libraries. Um, buying just, you know, a new monograph. Um, so let’s say like very optimistically, you’re getting $5 a copy that’s 500 bucks, right? Um, you know, let’s say 200 individuals buy your book, that was, you’re getting a a dollar a copy on there’s another 200 bucks, so that’s what, $700, right? And you’d be having a good year if you got $700 in your first year, um, you know, you’d be doing, you know, well for an academic monograph. So, uh, yeah, it’s not, not a lot of money.

Emily (22:02): Okay. I’m so glad we know like the order of magnitude, that’s exactly what I wanted. Uh, do you mind me asking, what about a book like yours that’s more, those this practical kind of guide? I know the, uh, what you wrote is part of a series from, uh, Princeton University Press, right? So like, can I have an example either of your book or, or similar books like that?

Laura (22:21): Yeah, yeah. So, um, and I do wanna say all of those numbers were just hypothetical and made up. So it’s not to say like the typical book sells makes $700 in royalties that I’m just, you know, putting it out there. Um, so yeah, so for a book like mine, which is sort of, um, positioned as, um, not, it’s not an academic monograph, you know, it’s not research based in that way. It’s going to be used by many more people than somebody who might just wanna read, um, a very specific, you know, narrow piece of research because it, you know, scientists could read it, humanity scholars, social science, people at all stages of their careers. You know, people who are, um, just finishing a dissertation and wanna publish their first book, people who wanna publish a second or third book, people who are mentoring those people, people who work at publishers, you know, so just have a much broader audience. So, um, the sales expectations for that are much higher, um, and have that it has played out that way, you know, compared to my dissertation book. Um, so I’m gonna try, I’m gonna try and think of, um, the numbers of sales. I think the first year it sold about 6,000 copies, I wanna say I don’t have the royalty statement right in front of me. Um, and the second year it, uh, I don’t think it sold quite that many, but it stayed up there. It was like four to 5,000 I wanna say. Um, and I’ve just gone into the third year, so I don’t have the, the numbers for that yet. So, so that’s a much higher number. And so that has led to, you know, higher royalties. It’s still not by any means the majority of my income. It’s still sort of supplemental income, but it is in the thousands of dollars as opposed to the hundreds.

Emily (24:16): Yes. Very, very good. Thank you so much for doing all this. Yeah. Like, um, order of magnitude and just like level setting and I, I really appreciate that

Commercial

24:25 Emily: Emily here for a brief interlude! Tax season is in full swing, and the best place to go for information tailored to you as a grad student, postdoc, or postbac, is PFforPhDs.com/tax/. From that page I have linked to all of my free tax resources, many of which I have updated for this tax year. On that page you will find podcast episodes, videos, and articles on all kinds of tax topics relevant to PhDs and PhDs-to-be. There are also opportunities to join the Personal Finance for PhDs mailing list to receive PDF summaries and spreadsheets that you can work with. Again, you can find all of these free resources linked from PFforPhDs.com/tax/. Now back to the interview.

Costs Associated with Publishing

Emily (25:16): I wanna talk more now about, um, not how the authors are making money, but the costs associated with publishing. You mentioned earlier that a publisher could be investing tens of thousands of dollars for each book that they’re putting out there. So can you tell us like, what, where are those costs coming from? Obviously I understand printing the book and so forth and there’s labor. What, what are the different maybe phases, uh, different types of people who have their hands on the book, what their different jobs are? And then I, I read in your book sometimes the publisher is gonna pay for these costs, but then also sometimes the author might pay some of the costs of, of this process. So can you kind of break that down as well?

Laura (25:52): Yeah, so, so the costs that the publisher is going to incur, you know, the, it’s the editorial labor, the editor that you’re emailing back and forth with the person who is, um, sending your manuscript to peer reviewers, wrangling those peer reviewers, then getting the reports. Then, um, you know, inside the publisher they’re making, um, presentations and pitches for your book that you might not even be aware of as the author, but the editor is doing all of that labor to get the publisher on board to say they wanna publish your book, all of that. Um, and that, that doesn’t even include like giving you feedback on the manuscript itself. Some acquisitions editors are able to do a little bit of that, um, but most don’t really have the time to give that kind of attention to the manuscript. Their, their role is more of a project manager, um, and, and an advocate for the project within the press. Um, so that happens within the press. Um, then, you know, there’s, uh, the, the production, so designing a cover, um, type setting the manuscript, so it looks like a book that can be printed on pages. There’s some design that goes into that as well. Um, most scholarly publishers do engage their own copy editors and proofreaders, um, where they would, you know, make sure the final version is like stylistically correct and grammatically and all of that. Um, uh, and then there’s the marketing and the publicity and, and all of that that goes to like making sure people know about the book and wanna buy the book. Um, and that’s not even getting into the, like the physical production of the book, which in my understanding is beyond the tens of thousands of dollars, the tens of thousands of dollars is just to get to that first proof electronically that they can then use to print the book and ship the copies and all of that. Um, so, so yeah, there’s a lot that’s going on there that is heavy on labor and so that just, um, incurs costs. Um, and of course none of that is what the author is also investing. So if you want deep feedback on your manuscript, that often doesn’t come from the publisher. It would come from a freelance developmental editor, um, somebody like myself, uh, or you know, my freelance colleagues. Um, and that money would come out of the author’s pocket usually. Um, and that could cost thousands of dollars, um, depending on sort of the level of feedback you’re looking for and how experienced of an editor you want and all of that. Um, there are also some costs associated with, um, the, you know, if you want images in your book, um, do you need to purchase the permission to reprint those images from whoever owns the rights? Um, if you want tables and diagrams, those have to be professionally drawn. Um, you might have a mockup, but then somebody’s going to have to draw that and make it look good enough to be in the book. So you might pay somebody to do that. Your publisher might hire someone to do that or have someone internal do that. They might pass that cost along to you. Um, since that’s sort of a choice you’ve made to include that in your book. Um, if you are citing, um, copyright protected material, you often need permission depending on how you’re using it. Um, that’s another thing the author is often expected to cover. Um, and then open access costs. Some publishers, you know, have, uh, infrastructure in place and they cover the cost of the open access. And when I say they cover the cost, they’re getting a grant or a subsidy or something to be able to do that. Um, um, but some will ask the author to pay a subvention, um, to, in order to make it possible to give the book away for free, essentially, thus, you know, reducing the revenue that might be expected from the book. Um, so, so i, I don’t know if that even covers everything that you asked about, but those are some of the costs that go into making a book and some of which are born by the author, some by the publisher.

Emily (30:07): Well, for example, in one of the later chapters of your book, you mentioned creating the index and you recommended yes, getting a professional to do that. That was something I was like, I never would’ve thought that was something that really would require like to do it. Well, it would require a professional. And so, and again, that’s a kind of cost I think you mentioned would probably be on the author most likely. Yes. So I was just kind wondering in general. Yeah, I mean you answered that very well. Thank you so much because it’s a little bit mind blowing just as a reader to understand all the different, um, people and elements that go into the production of a book.

Laura (30:39): Yeah, yeah. So the index thing, indexing thing is a great point. So yes, while presses often do cover a copy editor and a proof, not a proofreader, they’ll cover a copy editor. They will ask the author to proofread the proofs, the typeset proofs, and then the author might decide they wanna hire a professional proofreader or they might just do it themselves to make sure there’s no errors. Um, but the index is almost never covered by the publisher. It is something you can negotiate sometimes, again, if you have like an attractive project and they’re the publisher’s trying to get you to sign with them, um, sometimes they will cover it or um, charge it against your royalties. Um, but often you do, the author does need to provide the index, which again, you can DIY it and you get what you pay for kind of, um, or you can pay a professional indexer, which could cost a thousand dollars or more. Um, yeah, so it’s an investment the author makes in hoping it just makes her a better book product that people will use and cite and all those things we want for our books.

Emily (31:41): And I believe I also read in your book that sometimes this is what an advance is used for. Like the author might try to negotiate for an advance knowing that those are, there are cost coming down the line that they can use in advance to cover. It’s very different from the way I think of an advance, like in a, you know, larger household name publisher kind of situation. Um, and maybe that’s like just naive of me just not understanding much about the publication process. So I am getting the impression that we’re not making a living off of these books <laugh> maybe until you’ve published one every year for your entire career, maybe that layered by then you would have enough. Um, so given that, um, if authors are not really making that much money, you know, maybe hundreds or few thousands of dollars, um, per year directly from their books, how are they able to use those books to leverage into their careers, to earning more money, advancing their career in other ways? How does the books serve them in a, a less direct monetary way?

Laura (32:37): Yeah, I love this question because this is really what it’s about for scholarly books. It’s the book itself is an investment of labor, of time, of possibly money, um, that you’re hoping will pay off in some other arena, not necessarily directly through, you know, your royalties or in advance. And I do wanna say there’s a little sidebar, like commercial publishing is not that much more lucrative. Yes, we know about the celebrities who get the six figure advances or more, um, but most people who are writers who are just, you know, writing trade books also have another job. Like they’re not making their complete income off of writing their books. Much like academics who, you know, often if they’re writing academic books have an academic position, um, where they’re making some a salary, you know, that is their main source of income. And so the investment of writing an ac academic book is often for that job. It’s, you might need to write a book in order to um, you know, pass your three year review or go up for tenure. Um, a book might be an expectation in your field, so you’re not writing the book ’cause you’re gonna make money on the book, you’re writing the book because you hope you can keep your job, um, as a part of having published that book. Um, and you know, I’ve worked with authors who already have tenure but are wanna go up for full professor, which is a significant, um, raise, uh, in income, you know, in their salary and they can use the book toward that. So they see the investment of the book as paying off indirectly in that other way. Um, there’s also, um, you know, other sort of financial opportunities that could come from having written a book. So if you are invited to give talks based on your research, um, you know, giving talks at universities doesn’t always pay that much. It sort of depends on how in demand you are and, and how much funding those universities have to pay speakers. But if you have research that is applicable in industry or policy, um, or places that have kind of other kinds of funding, you can command more money than you ever would make from the book itself, um, in speaker’s fees, um, or consulting fees or things like that. So, um, you can sort of think of the book as a strategic investment in your reputation and your platform that then would allow you to command higher fees in other venues.

Emily (35:14): Yeah, I spoke with, uh, an author recently, actually, she was self-published, um, who described her book as like a business card, like going out into the world in front of her and opportunities come back to her because people are reading and using the book, right? So it’s not necessarily about that money that’s made directly. That’s nice, that helps. But as you said, there’s much more opportunity could be depending on, on the subject of the book on the backend through these other mechanisms. Um, but yeah, thank you for giving us that like wider picture of like why people would go through this process, which clearly is very time consuming and, and very full of labor and, and not, um, immediately seeing much ROI financially from it. Um, yeah, that’s great. Yeah.

Laura (35:55): Yeah. And I’ll say, uh, you know, many scholars, intellectuals, you know, they just have an intrinsic desire to share their knowledge and what they have found and what they’ve spent these years studying and discovering and concluding. Um, so I would say the majority of people I work with are, the money’s a bonus, you know, but what they’re really trying to do is just like, get the work out there. Um, and the book is the way they do that.

Emily (36:20): I’m wondering, do you ever work with people who are not academics? Like I sometimes hear people describe themselves as like independent scholars or something like that. Like are, would they still be a type of author who would publish with Yes. Scholarly process?

Laura (36:33): Yes, absolutely. I do work with many, um, independent scholars, people who have know, retired from academic careers or, um, just decided not to pursue one for whatever reason. Um, I would say, and those are the people who are sort of the most, I intrinsically motivated to share the work, um, because yeah, like what’s the gain for them? They’re not really getting paid to write the book, getting paid much. Um, and, and any payoff from it would come like later down the road. So, um, I, you know, I have many clients who are in that position. I will say it’s, it’s, you may have a bit less to invest in the book, you know, if you don’t have funding from a university, uh, you know, a research grant or something like that. Um, so, uh, yet you, everyone has to sort of make their own calculation of what it’s worth to them to invest in the book upfront.

Dr. Laura Portwood-Stacer’s Contact Information

Emily (37:29): I see. Well, Laura, this interview has been so insightful. I really appreciate you coming on the podcast and letting us know, um, all that you’ve learned and all that you’ve experienced through this publishing process. Would you please let people know how they can get in touch with you if they’d like to follow up?

Laura (37:44): Yeah, so I have a weekly newsletter, um, that’s probably the, the easiest place to find me. It’s the manuscript works newsletter. If you go to newsletter.manuscriptworks.com, um, you can get that, that shares lots of knowledge about scholarly book publishing and also some, you know, brief announcements of programs that I offer and um, ways that I support authors. Um, yeah, so that’s probably the best place to find me, but, uh, my more general home on the internet is just manuscriptworks.com.

Best Financial Advice for Another Early-Career PhD

Emily (38:14): Excellent. And I’d like to conclude with the question that I ask all of my guests, which is, what is your best financial advice for an early career PhD grad student, someone recently out of grad school or a postdoc? And that could be something that we’ve touched on in the course of this interview, or it could be something completely new

Laura (38:30): To understand the publishing ecosystem and where the money flows in and where it flows out and how much is gonna flow to you and be realistic about how that all works. Um, so I would not expect, I would not treat a book as, uh, a direct financial investment. You know, it may be a financial drain in many ways, but you think about the sort of broader context and, and what it might do for you.

Emily (38:54): Very good. I really think we’ve either done that in this interview or given people a really good head start on that process in the course of the interview. So Laura, again, thank you so much for your time. Thank you for agreeing to come on and um, I look forward to talking to you again soon.

Laura (39:06): Yeah, thank you so much for having me.

Outtro

Emily (39:13): Listeners, thank you for joining me for this episode! I have a gift for you! You know that final question I ask of all my guests regarding their best financial advice? My team has collected short summaries of all the answers ever given on the podcast into a document that is updated with each new episode release. You can gain access to it by registering for my mailing list at PFforPhDs.com/advice/. Would you like to access transcripts or videos of each episode? I link the show notes for each episode from PFforPhDs.com/podcast/. See you in the next episode, and remember: You don’t have to have a PhD to succeed with personal finance… but it helps! Nothing you hear on this podcast should be taken as financial, tax, or legal advice for any individual. The music is “Stages of Awakening” by Podington Bear from the Free Music Archive and is shared under CC by NC. Podcast editing by Dr. Lourdes Bobbio and show notes creation by Dr. Jill Hoffman.